How chapter 7 bankruptcy can Save You Time, Stress, and Money.

Sorts of collection pursuits That could be halted quickly include evictions, garnishments and repossessions.

With this in your mind, bankruptcy legislation exempts home that qualifies as “necessities of modern everyday living” — that is certainly, belongings needed for residing and dealing.

For any homeowner, a house loan servicing transfer has very likely transpired greater than after. To get a homeowner in Chapter 13, This will transpire within a couple of days from the filing on the bankruptcy circumstance, during the situation, or maybe at the summary of the situation.

Andrea practiced solely as a bankruptcy legal professional in customer Chapter 7 and Chapter 13 conditions for greater than a decade in advance of signing up for Upsolve, initial for a contributing writer and editor and eventually signing up for the crew as Managing Editor. Although in private exercise, Andrea taken care of... browse more details on Legal professional Andrea Wimmer

If you'd like to preserve the property that’s securing a financial debt, you'll need to carry on paying about the personal debt. Before you file, you must also ensure you’re present-day on your financial debt payments. Should you’re keen to give up the home, then Chapter 7 bankruptcy can erase the debt.

Don’t Shell out Creditors — Sounds weird, right? Listen to us out. Into the extent you could, continue on for making regimen payments. But any substantial or uncommon payments may very well be considered as “preferential transfers.’’ Which means a single creditor has benefited unfairly in excess of Other folks.

People today commonly receive bankruptcy discharge about two months immediately after their 341 he said meeting. The discharge could be the court docket order that lawfully removes your obligation to pay for your debts. This is normally reference lead to for celebration! You did it!

Bankruptcy Assets – United States Courts Online page, made up of information and facts concerning bankruptcy charges, charge waiver, credit score counseling organizations and debtor education and learning vendors, and implies tests

Here are some rules-of-thumb to take into consideration after filing bankruptcy to be able to build excellent fiscal habits.

Max Gardner taught me these ideas and we put into practice these procedures to protect homeowners through a Chapter thirteen bankruptcy case.

The technological storage or accessibility is needed to generate consumer profiles to send out advertising and marketing, or to trace the consumer on a website or across a number of Internet sites for equivalent promoting uses.

A further facet to consider is if the debtor go to the website can stay clear of a challenge by The us Trustee to her or his Chapter seven submitting as abusive. 1 Consider looking at whether the U.S. Trustee can prevail inside of a problem into the debtor's Chapter 7 submitting is if the debtor can normally manage to repay some or all of his debts away from disposable cash flow from the five yr time period supplied by Chapter 13.

Unlike Chapter 7, Chapter 11 makes it possible for the debtor to carry on running their business enterprise while creating a intend to restructure and repay debts. The debtor proposes a reorganization program, which has to be accredited by creditors plus the court docket.

Chapter seven bankruptcy is a typical lawful process to apparent see this your personal debt, but it really’s not right for everyone. Just one fantastic dilemma to talk to yourself if you’re thinking of Chapter seven bankruptcy: Do I've additional credit card debt than I’ll at any time be capable to shell out back again, provided my present earnings and house? If the answer is "yes," i loved this then Chapter seven bankruptcy would be the appropriate alternative.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Karyn Parsons Then & Now!

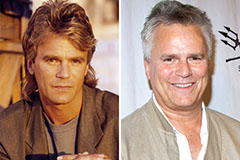

Karyn Parsons Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!